Introduction

What’s the hot news in the crypto sector? Which country’s platform is grabbing everyone’s attention?

Well, as of now, Canadian crypto exchange is the talk of the town.

Over the past decade, Canada’s cryptocurrency market has experienced unexpected growth and transcendence. The progress seems an uninterrupted ascending graph for now and then.

Today, Canada is the second country with a large number of crypto ATMs after the USA. Even some highly crypto-regulated countries haven’t achieved this milestone yet.

Do you have any idea how all this happened?

All because of ups and downs and a consistent regulatory framework. Businesses planning to start their crypto exchange in Canada or to make their services accessible to access for Canadian citizens must hear this out.

Let’s get to the evolution of Canada’s market first.

Canadian Crypto Exchange Market

Well aware that Canada holds a strong position in the crypto industry. To understand this clearly, we need to rewind a bit. Well, don’t panic, I’ll make this time travel as engaging as possible.

Early 2010

BTC got its name and became a global attraction from that moment. In this sector, the US has been dominant and remains so. At the time, Canadian users depended on foreign exchanges like Coinbase, Mt.Gox. Some of the exchanges have limited access to certain features. It occurs even in this period.

2013-2015

After noticing these scenarios, a local Canadian exchange crypto has launched. It was brought to suit the needs of their users, tied to Canadian regulations, and CAD currency support.

It’s QuadrigaCX, launched in 2013, that supports the deposit and withdrawal of CAD directly. It primarily focused on making Bitcoins accessible to the users. It also supported other cryptocurrencies. Well, good start, isn’t it? But it doesn’t end well.

2019

QuadrigaCX collapsed in 2019 after the founder’s death and alleged fraud. The private key to the funds of exchange was only accessible to the CEO. Some Netflix watchers might’ve guessed it. We can also name it as one of the controversial events in crypto history.

Yes, “Trust No One: The Hunt for the Crypto King” is a documentary that documents the entire incident and its aftermath. And that’s why getting the acquired license is a mandatory part of starting a crypto exchange platform.

Post-QuadrigaCX Fall

After such an incident, the Canadian crypto exchange market was rattled for a while. Coinsquare, also one of the oldest exchanges, has lacked a proper regulatory framework. But that’s the turning point for the emergence of the best crypto exchange in Canada. New platforms learned from the mistakes and rectified them with regulatory compliance and security.

Now we can see how legal crypto exchange in Canada entered the market with the regulations checklist.

Regulations in Canadian Crypto Exchanges

Before getting into the regulations, I’m gonna ask you a question.

Have you ever wondered what’s the missing part in QuadrigaCX?

Let me disclose it.

Three main things have been lacking on those.

- There was no mandatory registration for crypto exchanges during that period.

- No structured securities law applied to the crypto assets.

- Weak enforcement of Anti-Money Laundering(AML) standards.

So, how are the regulations perfected?

With the proper guidelines and registration procedures for the crypto trading platform in Canada. Let’s see the regulatory infrastructure one after another.

Canadian Crypto Regulations

FINTRAC and CSA are mandatory for obtaining a Canada crypto exchange license.

FINTRAC, Financial Transactions and Reports Analysis Centre of Canada is sort of an intelligence unit for finance. It gathers information regarding transactions and analyzes whether all of them are legitimate or not. FINTRAC prevents money laundering, illegal financing, and other activities. All Canadian crypto exchanges must register with FINTRAC to comply with the AML and KYC rules.

CSA stands for Canadian Securities Administrators. It strengthens and unifies securities regulatory practices throughout Canada. They revise and optimize the security policies for maintaining transparency and fair financial transactions.

Both are separate regulatory bodies. But overlap in their working processes, some of the Canadian exchange crypto platforms that are regulated by CSA must adhere to FINTRAC regulations.

Apart from these, there are provincial regulations that are to be considered. The regions like Ontario have their own rules and regulations with the Ontario Securities Commission(OSC). Well, if you’re starting your business, you need to register with OSC too.

Canada ranks as one of the top 10 countries in crypto adoption, based on the Chainalysis report.

Now let’s see how you can start a legal crypto exchange in Canada.

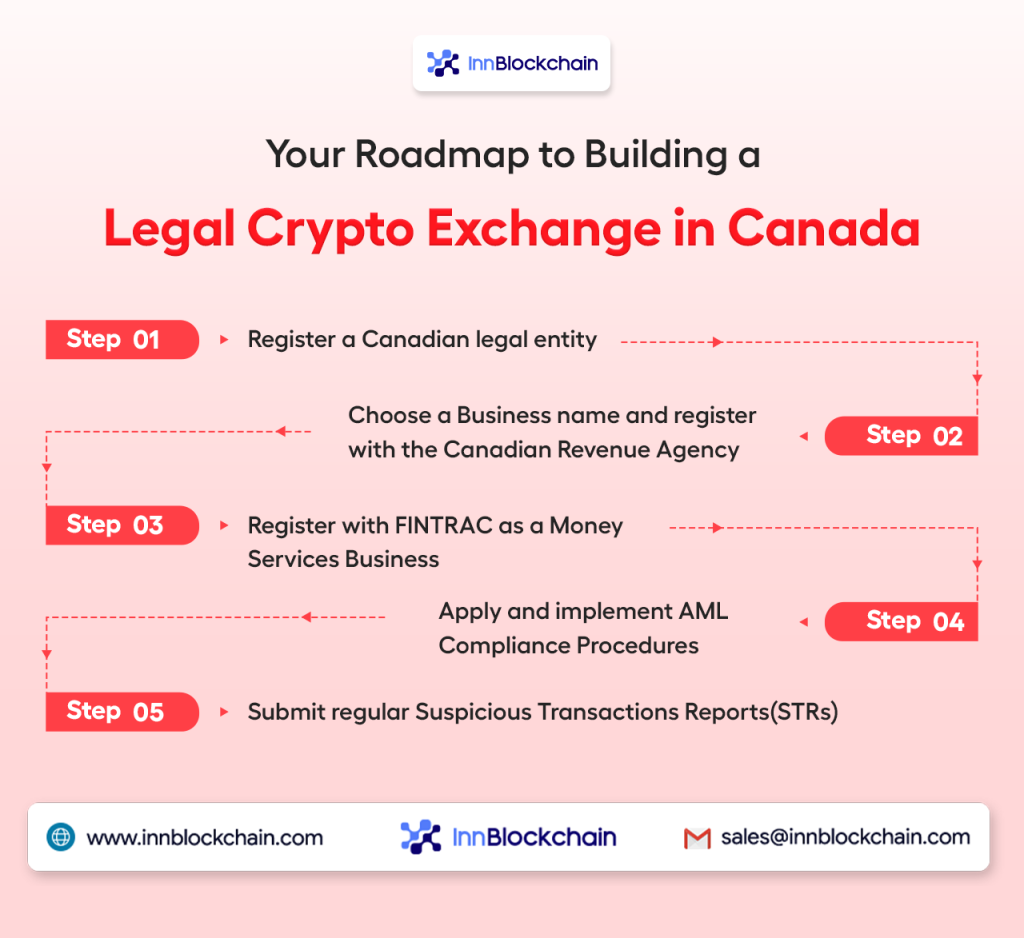

Steps to start a legal crypto exchange in Canada

#1 Register a Canadian legal entity

#2 Select a Business name and complete registration with the Canadian Revenue Agency

#3 Register with FINTRAC as a Money Services Business

#4 Apply and implement AML Compliance Procedures

#5 Submit regular Suspicious Transactions Reports(STRs)

FINTRAC ensures Money Services Businesses comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

It requires them to

- Register

- Report transactions

- Keep records

- Know their clients

- Maintain a compliance program

Hope you’ve understood the procedure for obtaining a Canada crypto exchange license. And you’ve figured out how the regulations are transformed and connected all the loose ends.

We can look for the best crypto exchange in Canada.

Best Canadian Crypto Exchange to look for

Best Canadian Crypto Exchange to look for

So far, there are numerous crypto exchanges in Canada with a high user base. I’m highlighting the 5 best Canadian crypto exchanges with their features.

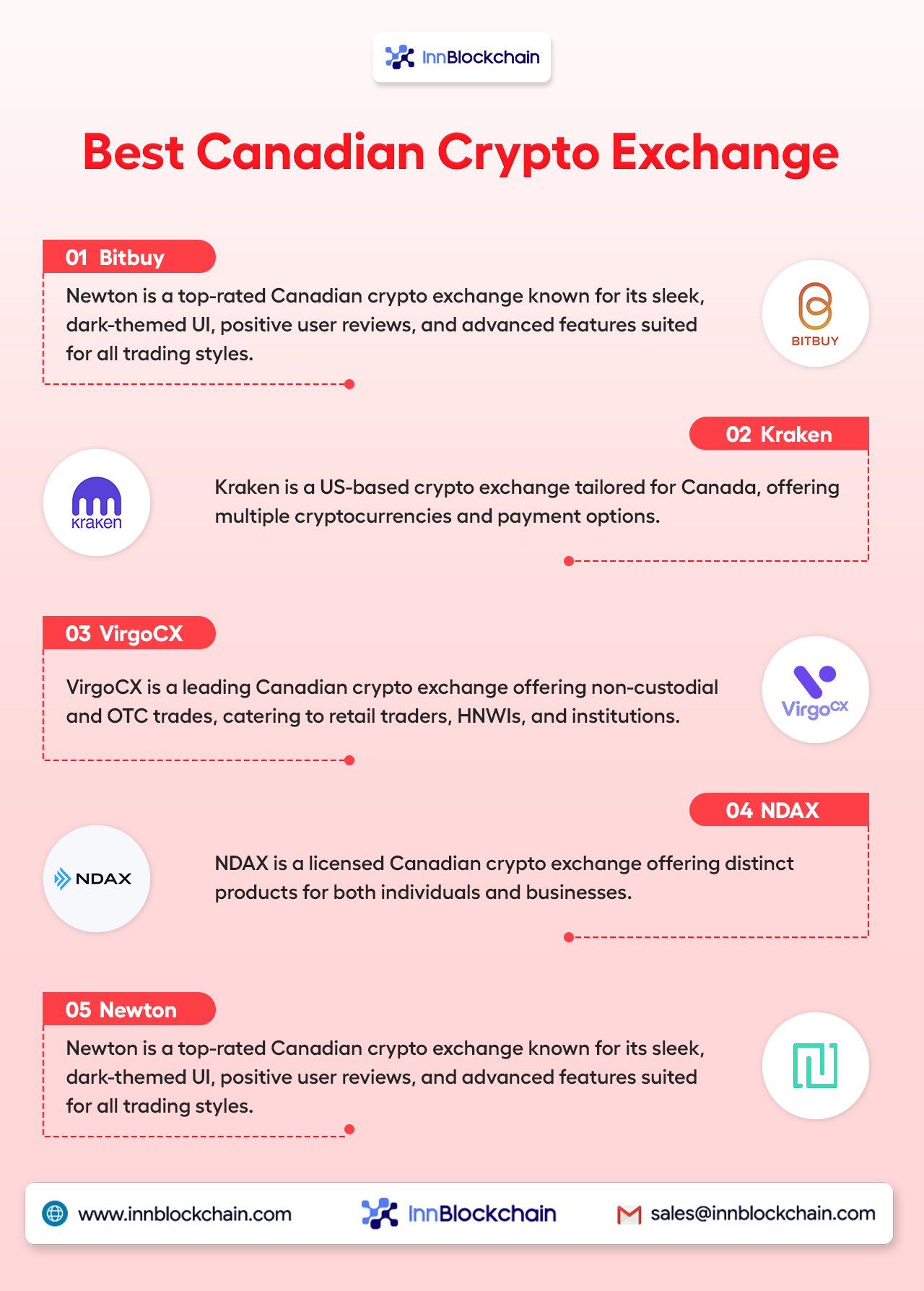

#1 Bitbuy

Bitbuy is one of Canada’s trusted crypto exchanges that suits Beginners well. And also provides various tools for advanced traders.

- Cryptocurrency Support: 50+

- Funding and Withdrawals: Interac e-transfer and Bank Wire

- Security: Users’ crypto assets are secured in Cold Storage with the Canadian Investment Protection Fund(CIPF)

- Registrations: FINTRAC as a money service business, CSA, and OSC

- Transparent Fee structure: 0% fee for CAD deposits. 1.5% for CAD withdrawals. 0.5% for Pro trades.

- Notable Features: Express trade, Pro trade, Staking, OTC, Corporate solutions, Affiliate programs

- Cross-Platform Compatibility: Android and iOS supported Mobile App

#2 Kraken

Kraken, a US-based crypto exchange optimized for Canada. Supporting multiple cryptocurrencies and payment alternatives, making it one of the best crypto exchange in Canada. Optimal for advanced traders because of its trading functionalities.

- Cryptocurrency Support: 400+

- Payment Gateways: Interac e-transfer, Wire transfer, Credit or Debit cards

- Kraken Pro: Spot and Margin with deep liquidity and high rate limits

- Notable Features: Margin, Futures, OTC, API trading, Staking, Affiliate Program

- Security: TFA, Proof of Reserves, Hot and Cold Wallet Solutions, SSL encryption, Global settings time locks

- Registrations: FINTRAC as a money service business, CSA, and OSC

- Cross-Platform Compatibility: Android and iOS supported Mobile apps and tablets

#3 VirgoCX

VirgoCX is a popular crypto trading platform in Canada supporting non-custodial trades. It’s one of the best Canadian crypto exchange that supports OTC trades. It grabs user types like retail traders, HNWIs, and institutional investors.

- Cryptocurrency Support: 400+

- Payment Gateways: Interac e-transfer, Wire transfer, Bill Payment, Credit and Debit cards

- Registration: PIPEDA(Privacy Act in Canada for Protection of Personal Information)

- Deposit and Withdrawal: Zero Fee, Trading Fee ranges between 0.95-1.6%

- Security: TFA, SSL Protocols

- Notable Features: Margin, Futures, OTC, API trading, Staking, Referral Program, Tiered Rewards Program, Gift Card

- Cross-Platform Compatibility: Android and iOS supported Mobile app

#4 NDAX

NDAX is a legal crypto exchange in Canada that provides products separately for individuals and businesses.

- Cryptocurrency Support: 400+

- Payment Gateways: Interac e-transfer, Wire transfer, Bill Payment, Credit and Debit cards

- Registration: FINTRAC and CIRO

- Payment Gateways: Interac e-transfer, Wire transfer

- Deposit and Withdrawal: Zero Fee, Trading Fee ranges between 0.95-1.6%

- Security: TFA, Cold wallets, MPC Hot Wallet, Multi-signature Approval, DDoS Protection

- Trading Fee: Around 1.2%

- Notable Features: Advanced Order Types, OTC Trades, Staking, Spot Trade, Auto Invest, Affiliate Program

- Business Products: OTC Desk, Crypto Mining, Treasury Service, Liquidity Providers

#5 Newton

Newton is one of the best crypto exchanges in Canada with a dark-themed and elegant UI. It is highly rated with more positive reviews for its best user experience. Like the previously discussed exchanges, it also carries advanced features. And as usual, all features are equipped for every trader’s tempo.

- Cryptocurrency Support: 70+

- Registration: FINTRAC and CIRO

- Payment Gateways: Interac e-transfer, Wire transfer

- Deposit and Withdrawal: Free EFT withdrawal

- Security: Role-based Access, TLS Encryption

- Trading Fee: Between 1.0-1.6% based on the Tiered assets. It also varies based on the time duration.

- Notable Features: Advanced Order Types, OTC Desk, Staking, Spot Trade, Convert, Multi-network Support

- Cross-Platform Compatibility: Android and iOS supported Mobile app and web app

In the earlier crypto trading platform in Canada, we’ve noticed a lack of securities law and proper registration procedures.

And now, what did we observe here?

- Proper AML/KYC Implementation

- Investor Protection

- Proper licensing and registration

When you get all your regulatory work done, you’re at the right pace to start your legal crypto exchange in Canada. And your business getting successful is inevitable.

Now we’ve discussed enough of the decorative features of top crypto exchanges. Let’s move on to Cons of these crypto exchanges.

Pros & Cons of Top Canadian Crypto Exchanges

I’m gonna put forth the pros and cons of those top 5 platforms. You need to take lessons from these and begin your platform all set right.

Pros of Best Canadian Crypto Exchanges

- Regulatory Framework Satisfied: It’s clear that all of them got their Canada crypto exchange license from FINTRAC and CSA. This is where QuadrigaCX failed.

- Prioritized Security: It’s surprising that most of the exchanges bear more than 3 security protocols, and they also secure users’ funds with cost storage that many US-based platforms lack. With this, Canadian crypto exchanges have won the heart of their users.

- User-Focused Features: All the crypto exchanges in Canada made their features simple, with limited trading orders. Rather than its limitations, this minimal feature is well-suited for beginners because Canada has more beginner-level traders. The exposure of cryptos has grown in recent times; it’s the best start.

- Comfortable Payment Options: Interac e-transfer and Wire transfer are the most-used payment methods in Canada. And all the platforms have satisfied it and made all their users deposit and withdraw conveniently.

- Advanced Trading Features: It’s unbelievable that most of them support OTC services. It’s also quite rare to spot in US-based crypto exchanges. Only advanced features can take a crypto platform to a higher level and reputation.

Cons of Best Canadian Crypto Exchanges

- Minimal Currency Support: A Crypto trading platform in Canada focuses well in supporting major cryptocurrencies, but many users invest in altcoins. This reduces users’ interest in trading on your platform. And they’ll go to platforms like KuCoin, which support Bitcoins and AI-powered coins like Lay AI.

- Limited Payment Gateways: Every legal crypto exchange in Canada integrates its region-specific payment methods. This helps your business to reach Canadian users alone. Integrating more payment methods, like PayPal and local payments based on your targeted countries, is required.

- Short in Advanced Trading Features: Now, hybrid concepts are becoming common in crypto exchanges. Features like NFT marketplace and DeFi protocols are absent in the best crypto exchange in Canada. But when you see it in the long run, these alone won’t help your platform scale higher. This hinders your platform from reaching more countries, excluding Canada.

- Constrained Global Reach: All the features, regulations, and payment methods define a platform’s global reach. As we’ve discussed earlier, they lack all these factors. Sure, Canadian users will increase, but it restricts users from various regions from accessing.

- Limited Brand Exposure: Even though they have better crypto exchanges, I don’t find better marketing strategies on their platforms. Implementing appropriate marketing campaigns helps them reach global users and investors. Hence, it boosts the credibility of their brand.

I hope the key points came through clearly.

Don’t you feel curious to explore the future developments of crypto trading platforms in Canada?

Future Developments in Canadian Crypto Exchange

It’s undeniable that Canada’s crypto adoption grows stronger. We’ve seen more and more enhancements they’ve made so far.

And the result?

Around 5-10% of the Canadian population owns cryptocurrencies.

Well, they never settle for these alone. They’re aiming for big. Yeah, the next phase of crypto evolution is likely to surprise us.

Regulatory Practices

- From 2026 on, Canadian exchanges will have to notify the Canada Revenue Agency (CRA) about crypto trades made by Canadian customers.

- CRA is about to update guidance on staking, DeFi, and NFTs in Oct 2025. We can also expect proper regulations on stablecoins, too.

- Above all, Canada’s tax policy is also about to be revised. It’s gonna give clarity on crypto income, capital gains taxes, and staking rewards.

Integration with Banking Sector

- Canadian crypto exchanges, in partnership with traditional banks, are next in line for future development.

- Also, working on Central Bank Digital Currency(CBDC) to transform the digital currencies’ functions and it’s use cases in cryptocurrency exchanges.

Global Expansion

- Businesses understood that acquiring a Canada crypto exchange license is not enough to operate their platforms across various countries.

- They’ve started integrating more fiat currencies and payment options to form a global audience.

- In addition to this, they’ll improve their regulatory compliance, like EU or US standards.

Environment Concern

- Rising awareness of the environmental impact of Proof-of-Work(PoW) blockchains may lead exchanges to support greener alternatives.

- Ethereum 2.0 or other Proof-of-Stake(PoS) platforms can be seen shortly.

Apart from these, more advancements in NFTs, DeFi, and Web3 will be noticed in Canadian crypto exchanges. Improvement in mobile app’s performance, speed, and many more to be seen soon.

These are all the signs that crypto exchanges in Canada are strengthening their rules, regulations, and advancements.

We can see in what ways Canadian exchanges are raising the bar globally.

What makes Canadian Crypto Exchange a model for Global Platforms?

Alright, before winding up, I’m gonna present you with the standards you need to meet when starting your crypto business. With Canadian crypto exchange as a role model, not only you, but every global platform must learn from it.

- Strong Legal Foundations

All the currently functioning Canadian crypto exchanges are properly registered with CSA and FINTRAC. Some platforms like VirgoCX are increasing their thresholds for international regulations.

- Advanced Security Protocols

SOC 2-certified systems, Multi-signature wallets, and Cold wallets are high-end security measures. And most existing platforms covered these protection standards. Many global platforms must take this into account and work on implementing these protocols.

- Transparent Fee Structures

Crypto users and investors choose the platform that provides clear and transparent trading fees. And all the best Canadian crypto exchange hooks up traders with straightforward pricing models.

- Premium Features and Services

Staking, OTC services are present in many crypto exchange in Canada. And some of them are dedicated OTC platforms. And platforms like NDAX extend their features to businesses, too.

Here, I’m gonna disclose a huge fact on Bitbuy. Bitbuy has a history of never being hacked in the hack-prone era. Most of the OG platforms like Binance, Bybit experienced security breaches.

Bitbuy protects its users’ funds by 90% of users hold funds in cold storage with the Proof of Reserves Audits. Hope every crypto exchange platform in the world prioritizes the security of sophistication like Bitbuy.

Well, it’s pretty sure we can witness more best Canadian crypto exchanges in the market. And, hope I haven’t let any loose ends and bored you at any point. It’s time to consolidate these points into a meaningful close.

Signing off with insights every entrepreneur in crypto should carry forward.

Conclusion

Having covered the regulatory terrain in depth, the emergence of legal crypto exchanges in Canada now stands well defined. And it’s yet to experience more and more ground-breaking advancements.

So, entrepreneurs, when are you gonna make such a move?

The crypto industry is gonna witness innovative developments. All the insights are at your fingertips. When are you gonna start your own, like the best Canadian crypto exchange platforms we’ve explored?

Well, if you’ve made up your mind to do so, you need to give your ideas to a trusted cryptocurrency exchange development company on this. It helps you build your dream crypto exchange platform with your business blueprint.

The time to build your legacy has come! Build a purposeful business, not just focusing on Revenue but something valuable.