The financial system has enhanced over the years. The rise of new technologies has made financial services more trustworthy, reliable, and secure. The rising financial technology crates questions among the users of DeFi vs CeFi Which one is better?

Decentralized Finance is an emerging innovation in this era. Some think that it is the most expected financial liberation. Many of them fear it may interfere with the traditional financial system. While some people don’t even know about the term “decentralized finance”.

Despite your geographic location, you are in the right place. This article will help you to learn more about Decentralized Finance and Traditional Finance. Moreover, here you can learn about the comparison of DeFi vs CeFi. Read on.

What is the key goal of DeFi & Traditional Financial Systems?

Both traditional and decentralized finance are involved in fund movement associated with several financial transactions. Some of them are lending and borrowing funds, offering liquidity, and others.

Banking institutions play a critical role in the traditional system. They hold the funds and distribute the funds to the respective entities based on their requirement. Generally, traditional systems provide essential fund supply.

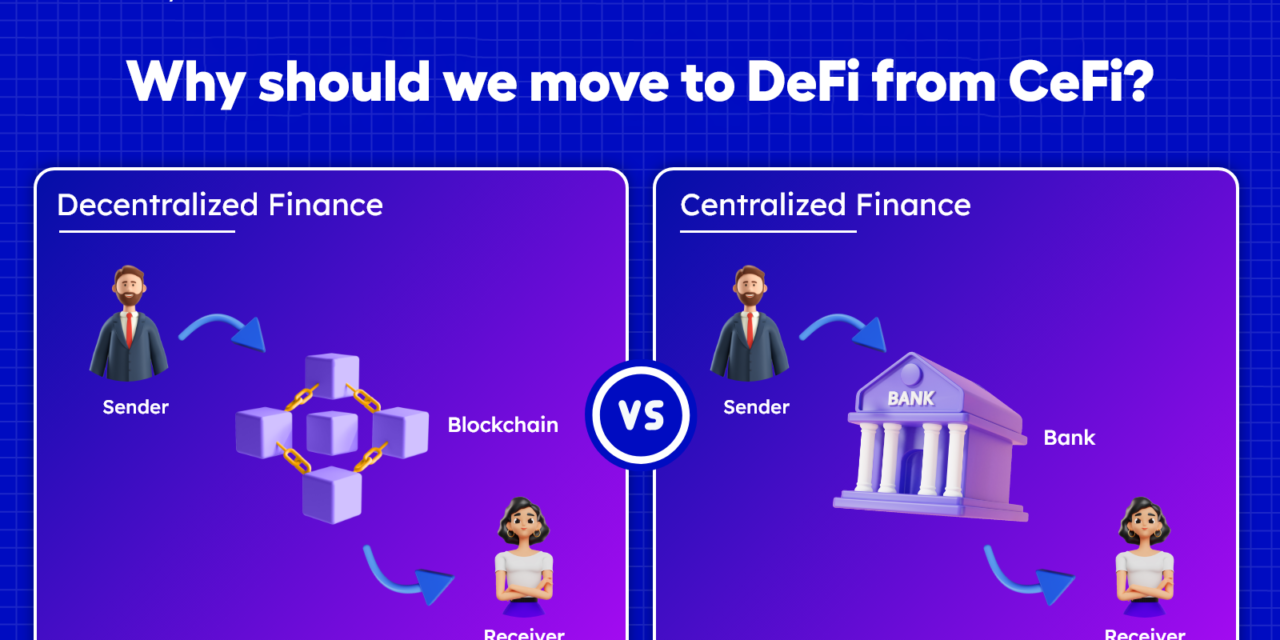

On the other hand, Defi aims to provide hassle-free financial transactions compared to traditional systems. Here the absence of a third party makes the users interact with each other on a p2p basis.

Compared to traditional finance, Defi has certain goals like:

- Fast transaction

- Funds for all users ( no credit check is done)

- Access globally without setting up a bank account.

What is traditional Finance?

Traditional finance is especially for money lending via financial institutions like banks. TradFi is an old system that uses third parties for transactions. All transactions take place via the system. Here users have to submit all their personal financial data to access banking services. If you have a bank account, then you have used the TradFi system. This is the system that has been widely used among people for a long time.

Download the profit you get on investing in a centralized crypto exchange 👇

Decentralize Finance Definition

Decentralized Finance is an emerging financial technology. It is developed on a public blockchain, facilitating higher efficiencies compared to traditional systems. It includes smart contracts, protocols, and digital assets. Defi utilizes these enhanced technologies to verify transactions and transfer money. For more knowledge let’s dig deeper into TradFi and DeFi comparison.

Differentiation of DeFi vs CeFi Systems

Note: To take a quick insight into the major difference between TradFi and Defi

Accessibility

TradFi restricts access depending on geographic location, wealth, and credit history. Whereas Defi flatters itself on democratizing finance. Anyone with internet access can take part in the Defi environment, providing opportunities for financial inclusion to the underbanked or unbanked population.

Transparency

Mostly TardFi was criticized for its absence of transparency. Complex terms & conditions, Hidden fees, and decision-making processes are rarely disclosed. On the other side, DeFi operates on the public blockchain, providing transparency. Here every transaction is recorded on the ledger which is permanent and can be verified by everyone.

Security

In TardFi, security is provided via regulatory oversight and insurance schemes. Still now, individual accounts are targets for fraud. Whereas DeFi utilizes cryptographic techniques for security purposes and its decentralized nature removes the central point of failure. However, the usage of smart contracts controls massive losses in Defi.

Efficiency and Speed

In some cases, Traditional Finance is slow because of manual intervention. For international transfers of money, it takes too long time to settle. Where blockchain-based Defi processes the transactions rapidly, irrespective of geographical location.

Control and Privacy

TradFi demands their users trust third parties for their personal data and money. Banks will take full control over account holders, how their money is spent, when to give access to their money, etc. But DeFi gives users complete control over their data and funds. Because of smart contracts users interacted directly, thus minimizing the need to share personal data.

Regulation

TradFi is highly controlled, providing protection to users but limits inclusions and innovations. In contrast, Defi operates in a grey area, which facilitates quick innovation. Globally, regulatory bodies are sketching out the tactics to deal with Defi and other blockchain-based innovations.

Interest Rates

Interest rates in TardFi are comparatively low, which is below inflation rates. On the other hand, Defi provides high rates due to the absence of middlemen, the efficiency of smart contracts, and some new mechanisms such as liquidity mining, yield farming, etc.

Innovation

Currently, DeFi outstrips TardFi in terms of innovation due to its open-source and composability nature. New financial services and products are being built at an unprecedented rate in the DeFi ecosystem. Whereas TardFi with its rigid regulatory requirements and legacy systems bit slower to innovate.

Ownership of the money

In conventional banks, funds are stored on the bank side, suppose you want to make any transaction then you have to send a request to the bank. Banks will process the request and decide whether to process/violate the request. In some cases, the bank will block you from getting paid due to certain violations. Now you think of it with the Defi platform, the users will have complete control over their funds. This means you will decide to spend the money.

Intermediaries and Processes

The main difference between TradFi and DeFi is the involvement of intermediaries. In TradFi, there are intermediaries and some manual processes that lengthen the money transfer for a day. Meanwhile, Defi entirely replaces or cuts off intermediaries with automatic smart contracts. This allows Defi to complete transactions in a minute with enhanced transparency.

Management

The decentralized nature of Defi eliminates central management. Here instead of the third party smart contract manages all engagement. On the other side, Traditional Finance controls all the activities with the help of a central authority. Moreover, user’s funds and personal data are managed by the bank.

Hosting

As a technological invention, Defi executes on Blockchain. In turn, the internet hosts the blockchains. This makes Defi not depend on a physical premise to operate. Whereas TradFi is a brick-and-mortar model that depends on physical premises for function.

Geographic Extent

DeFi irrespective of geographical location. One could simply access the services globally. People at any extent of the world could transact. However, TradFi is bound by time and space. Moreover, financial institutions have jurisdiction outside that they couldn’t operate. And most of their services are obtainable within working hours.

Nature of Assets

In DeFi platform, the users transact with cryptocurrencies. Whereas in TradFi, the users use Fiat currencies for transactions.

Gatekeeping

The decentralized nature of DeFi removes intermediaries. Here transactions are p2p. This means direct transactions of peers take place through smart contracts. On the other side, Traditional Finance has numerous gatekeepers. They have numerous agents and players who interrupt the transactions.

Flexibility

In DeFi users have a flexible experience. One can simply change the interfaces on their dApps whenever they wish. They can either custom according to their need or can source from third parties. Whereas, in the TradFi system this is not the case. The central authority develops the customer policy.

Interoperability

DeFi facilitates interoperability. The growth of the defi crypto leads to new products and services. This product or service can built on existing dApp providing greater functionality. On the other hand, TradFi won’t allow interoperability. Every user has a unique product. No one can alter or build on it without getting permission from the owners.

Lending

In Decentralized Finance, such as Aave or compound, the amount you borrow is limited to collateral factor. Based on the deposited cryptos, you can borrow upto 70 – 80% of your collateral. DeFi paves the way for a trustless manner only because of smart contracts. But here it forces the users to borrow what they afford. Comparatively with the TradFi system, you can say Borrower will repay the debt promptly. This lending practice leads to a precarious financial situation.

Yield farming

The key goal of TradFi is to put your money to work. TradFi allows investors to guess stock prices and gain compound interest via dividend payouts. Though these strategies have been in progress for more than a decade, new options are on the horizon. Whereas DeFi in cryptos lets you lend and gain a modest interest from it. This loan could be deposited and loaned out on Aave or compound interest for additional earnings. This process of yield farming helps your cryptos to work across various Defi platforms.

DeFi vs. CeFi: Which One Stands Out?

TradFi is a well-recognized system globally. Presently, it serves a larger part of the world’s population. However, things are changing fast. People are peeking for ways to well manage and control their finances better than now.

Today, Decentralized Finance is an efficient alternative to TradFi. DeFi has presented digital ledger technologies. This new invention facilitates people to transact more privately, securely, and efficiently, Suppose are you in search of a system which facilitates you to transact anonymously, then DeFi is the right choice.

DeFi uses open-source code which helps the developers to upgrade financial products simply. Their goal is to provide trustable and better financial services. Getting a loan is also a simple process as you need not worry about your credit score. Hence decentralized finance stands ahead of TradFi.

Conclusion

Though Traditional Finance is used as mainstream for financial transactions in many countries, the concept of Decentralized Finance is completely profitable you can see its pros and cons from the above section Defi vs CeFi. You can utilize Defi to keep and gain profit by following best practices to improve DeFi security.

Thus, Try it now with the DeFi development company.