Nowadays, Decentralized Exchanges are ruling the whole crypto economy with their high-end features and low gas fees. Kick-starting a decentralized exchange business is a dream and an ambitious goal for many entrepreneurs. After experiencing the success of DEX, many people are surfing with many queries. Among them, one of the most common queries is how to build a decentralized exchange platform. For those people, this article will be a key to their success.

This article describes what DEX is, why DEX will be more popular in 2025, and also answers the question of how to create DEX.

To make it clear, let’s go deep into the topic!

What is a decentralized exchange?

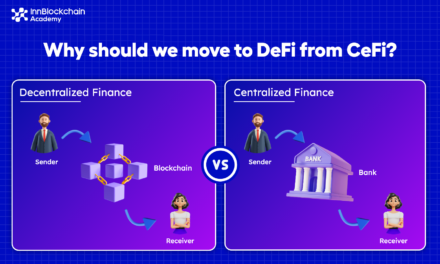

Decentralized Exchange is a digital currency exchange where users can transact directly in a P2P manner over a secure internet platform without the need for intermediaries. DEX varies completely from the traditional centralized exchange, where transactions take place with the help of a party on the platform. Whereas DEX leverages blockchain technology, smart contracts, and P2P trading to provide users greater control, privacy, anonymity, security, and transparency over their assets while transacting on the platform.

Generally, people prefer to do transactions without the intrusion of others. So DEX suits people who prefer privacy, anonymity, transparency, and security while trading. In the DEX platform users can trade, stake, and swap cryptos by connecting their crypto wallets, like Trust wallet or Metamask wallet.

DEX platform is broadly classified into three types

AMM (Automated Market Maker)

It is one type of DEX platform that relies on a protocol by removing the traditional order book which is used in conventional crypto exchanges. AMM operates on the principle of liquidity pools. Instead of matching buyer and seller directly, they utilize liquidity provided by the users to facilitate trade.

Order Book DEX

Order book decentralized exchanges (DEXs) are one type of decentralized exchange platform that operates similarly to traditional centralized exchanges in terms of trade matching and order placement. Unlike AMM DEXs, which use liquidity pools, order book DEXs rely on order books to match buy and sell orders.

DEX Aggregator

DEX aggregator is a financial protocol that facilitates investors/traders with simple access to a variety of trading pools or liquidity pools in a single dashboard. This means the platform combines liquidity from multiple DEXs to offer users improved access to trading pairs and get better prices.

Why is Decentralized Exchange popular in 2025?

By this time, you may have recently heard the news about the death of QuadrigaCX founder Gerald Cotton, Who left about $190 million in cryptocurrency on his exchange inaccessible by anyone. In one word, Inaccessible! $190 million in cryptocurrency vanished in QuadrigaCX’s death.

The real issue behind this issue is the use of centralized exchanges that hold user’s cryptocurrencies and private keys. As it is centralized, these cryptos are accessed only by a single person – QuadrigaCX. So no one accessed the exchange on his death. Likewise, suppose the exchange goes for maintenance or is breached or shut down, then the exchange’s users are out of luck and money.

Not only QuadrigaCX death, there are also many incidents that increase the popularity of DEX in 2025.

To keep the user’s cryptos and keys safer, there is a need for a shift from centralized to individual key management—decentralized exchange. People started to realize the importance of protecting their investments and data. It’s not only about trading; they ensure that the platform gives high priority to safety and privacy. The following are some of the key characteristics and benefits of DEX:.

User Control

In DEX, users have complete control over their funds. There is no need to deposit their cryptocurrencies into the exchange, which minimizes theft or hacking.

Security

DEX is considered a more secure platform as the user’s data are entirely stored on the distributed ledger. Moreover, the user maintains their private key.

Privacy

DEX prioritizes user privacy. Users can simply trade without undergoing verification procedures, whereas it is mandatory in a centralized exchange.

Global Access

Decentralized exchange provides global access, regardless of their geographical location, as they won’t rely on third parties to facilitate the transactions.

Censorship Resistance

The DEX is censorship-resistant, they won’t rely on any central authority to operate. This is suitable for a country with strict financial regulations.

Transparency

Mostly DEXs operate on public blockchain, offering transparency in all transactions. As the data is stored on a public blockchain, users can easily verify transactions thus ensuring fairness and integrity.

Reduced Fees

The fees charged on the DEX platform are less than the centralized cryptocurrency exchanges. There are no additional fees charged for middlemen.

Steps to build a decentralized exchange Platform

Define your requirements and business goals

To build a decentralized exchange platform, you have to carry out some market research in the crypto space. Primarily, you have to analyze the crypto market, how it is functioning and what are all the pros and cons of your competing exchanges. Likewise, you have to analyze the price fluctuation in the crypto market. The crypto market is highly volatile due to market performance, sentiment, and other economic reasons. So you have to carefully analyze whether this is the right time to start the business or not.

Once you decide to start the business, before crafting your DEX platform, you have to define the key purpose of your DEX, the types of cryptos you wish to support, who your target audience is, and more. Determine how your DEX platform would generate revenue, what are all the fees you are going to charge, and how your users are going to interact with your platform.

Compliance & Regulations

The laws and regulations related to cryptocurrency and financial services vary from one country to another. So proper due diligence to understand the regulations and compliances of the respective jurisdiction and obtain the licenses before launching is most important. Suppose you are operating globally; then you must have knowledge about multiple jurisdictions.

Determine the types of licenses needed to launch your platform, as the license may vary based on the exchange type. However, check whether the assets listed on your DEX have to satisfy security laws. Because there are so many security laws imposed for trading and listing assets. Like this, every jurisdiction has separate legal compliances and regulations. So work closely with your legal advisor to determine the right for your operation of the platform.

For example, in the US, exchange operators must acquire proper licenses from the jurisdiction for money transmitter businesses. They have to follow SEC and CFTC rules and more regulations. Whereas in China, the cryptocurrency is banned. Hence, it is better to consult a legal expert in the crypto field before starting your business.

In many places, crypto trading platforms are operated without significant oversight. However, in the US, the DEX operator must get licenses from the government for Money Transmitter Businesses. Moreover, they must also follow SEC & CFTC rules and regulations. Hence, consult a legal expert in the crypto field before you start to build a decentralized exchange platform business in your desired country.

Choose the blockchain network

In the world of blockchain technology, selecting the right blockchain network for your exchange platform is the most crucial decision that makes or breaks your journey toward success. Initially, entrepreneurs won’t have an idea about blockchain to choose the right one. So here, let me list some key factors which help you choose the right blockchain network.

Public vs. Private

Public networks like Ethereum, Bitcoin, etc are accessible via the internet, and anyone can run the nodes. Public networks have existing infrastructure, so it is cheaper to join but there are some limitations over control. Moreover, there are many bottlenecks that will trim the performance. On the other hand private blockchain is run by an organization, which gives high performance while providing more privacy options. It is much simpler to use private network with niche-specific applications.

Available Functionality

All blockchains may follow the same technology, but the features they use will determine their functionality. Their primary purpose varies from one network to another, as they are designed to process the data differently. For example, let’s consider Ethereum, Bitcoin, and Ripple. All three blockchains do financial transactions. Among them, Ethereum enables smart contracts, Bitcoin acts as a decentralized currency, and Ripple enables cross-border monetary transfers. Based on this, you can select the blockchain that best fits your business.

Platform Security

All blockchains are designed in a secure way to share and store data, but they follow various security measures. Suppose your project handles private and sensitive data. While choosing, check the security measures of the blockchain, like the cryptographic method, how often they update the platform, and how the users are verified..

Network Community Adoption Rate

The number, diversity of brands, and the community surrounding the platform indicate the robustness of the platform. Dynamic blockchain platform has the potential to address and implement technological advancements as they change over time. Besides the robust blockchain will regularly update and patch up the rising bugs and security issues.

Based on the above key factors, you can choose the blockchain network from the list of blockchain networks like Ethereum, Solana, Ripple, Stellar, Corda, Hyperledger Fabric, etc.

Design Architecture

Of course, you can’t create DEX without sketching out an architecture. For an average business owner, architecture might sound too technical. But at the same time, it’s mandatory to sketch the architecture.

It’s not difficult, I promise

In practice, while crafting architecture for your own exchange, try to ask the following questions to yourself. They are,

- Do you want a DEX?

- How many users do you like to serve concurrently?

- How quick will the transaction be?

- What is the processing speed of your exchange?

- What front ends do you envision?

By answering all the questions, you can easily craft the building blocks of your product, arranging and interconnecting all the blocks so you can form a complete architecture. This helps the developers work on a particular chunk of the exchange simultaneously, which helps in quick development.

DEX Protocol

DEX protocol is a set of rules and algorithms which governs the operation of a decentralized exchange. DEX is a platform that facilitates p2p trading of cryptocurrencies without the intrusion of third parties. Generally, DEX protocols are built on blockchain technology and also utilize smart contracts to automate and implement trading functions.

- Uniswap (UNI): Uniswap is the first Ethereum-based DEX that enables the swapping of ERC-20 and NFT-type tokens. However, users can list their tokens for free on the exchange.

- SushiSwap (SUSHI): Incentivizes liquidity providers with SUSHI tokens and also provides complete control to the community via its decentralized governance model.

- PancakeSwap (CAKE): PancakeSwap is a decentralized exchange on the BSC. It gained popularity for its low transaction fees and high liquidity in the tradable assets.

- Balancer (BAL): Balancer is an AMM DEX built on Ethereum. It allows the pool operators to fix their swap fees. Moreover, it provides both private and public pools.

- 1inch (1INCH): As a DEX aggregator, the 1inch network allows users to execute low-cost asset swaps from various liquidity sources to find the best possible trading rate.

The above listed are the top 5 DEX protocols. Each protocol has its unique features, tokenomics, and governance structures, but they share the common goal of offering decentralized and permissionless trading of digital assets.

As the DEX ecosystem is dynamic, so new protocols may emerge over time with different innovations and approaches to fix the rising needs of the DeFi space.

Develop Smart Contracts

Smart contracts are a self-executing program that executes on the blockchain platform to automate the transaction process between the users. You need to write smart contracts in programming languages like Solidity or Vyper that will be compatible with all blockchain networks that you prefer to choose.

While creating the smart contract, consider the following core functionalities:

- Order Book: Implement order matching and execution logic.

- Liquidity Pools: Develop contracts to manage liquidity pools and AMM functions if applicable.

- Token Standards: Utilize standard token contracts (e.g., ERC-20) for representing assets.

- Trade Settlement: Execute logic for settling trades, thus ensuring assets are transferred securely between the users.

- Fees and Rewards: Implement a fee mechanism for trades and liquidity provision.

The above listed are some of the common functionalities to be considered while crafting the smart contract.

Build the UI/UX

It is most important to create a user-friendly interface because this is the one which grabs more users to your DEX platform. The users on your platform must find it easy to navigate all options like trading, listing, and withdrawing tokens from liquidity pools, and they must also get all-time support from your side.

Moreover, make sure that your DEX platform provides detailed information about the listed assets including their symbol, name, price, description, market trends, and trade volume. Detailed visualization would minimize the possible UX-related issues

Implement Advanced Features

Implement the following advanced features to make your platform unique among the competitors:

Atomic Swap

DEX allows users to swap one cryptocurrency for another directly through smart contracts, offering a simple and direct way of exchanging digital assets.

Multi crypto support

Decentralized exchange platform is designed to support all cryptocurrencies, enabling users to trade on the DEX platform with their own currencies.

Order Book

DEX developed an order book to handle all buy and sell orders. This book shows the user’s transaction history, including order placement, order matching, and order execution.

Slippage Tolerance Setting

Setting up the slippage tolerance enables users to control the maximum permissible difference between the expected price of a trade and the executed price while swapping.

Syrup Pools

Syrup pool is generally used for token promotion, where your platform users stake their native token, like CAKE, to earn rewards in terms of other tokens.

Crypto Staking

Crypto staking allows users to stake their tokens on the platform to earn rewards or interest for their lock-up periods.

Interoperability

DEXs leverage cross-chain interoperability protocols, which means traders can trade assets across various blockchain networks within a single platform.

Automated Market Making (AMM)

AMM algorithm helps to determine asset prices and facilitate transactions. Moreover, it is a good replacement for traditional order books.

Liquidity Pools

Liquidity pool is a collection of funds locked in a smart contract on DEX. Allows the investors to earn passive income and rewards for participating in the pool.

Acquire Liquidation

To liquidate a company, you have to talk to an IP (insolvency practitioner) to understand your options. Then, as a platform owner, you have to arrange a meeting with your shareholders. After deciding, make an agreement with other directors of your shareholders and get approval from them. Then appoint a licensed insolvency partitioner to manage the liquidation.

Another way to liquidate your company is by integrating a trustworthy liquidity provider from outside. An LP (liquidity provider) is one who supplies buy and sell orders to DEX to increase market liquidity. This is done by depositing crypto assets into a pool, where other traders can utilize these cryptos to conduct swaps on the platform.

Security Measures: to safeguard your user’s funds and the integrity of your platform.

Implement strong security measures for your DEX platform to safeguard your user’s funds and the integrity of your platform.

- Encrypt sensitive user transactions and data to protect against data breaches.

- Employ DDoS (Distributed Denial of Service) protection measures to mitigate the risk of attacks that disturb your DEX’s availability.

- Conduct regular security audits on both the front-end and back-end components of your DEX platform.

- Craft a plan to respond to the security incident. Outline the steps to be taken in case of security breaches, like freezing users’ accounts, conducting an investigation by unknown users, and communicating with the affected users.

- Update your DEX software with the latest security measures and keep your DEX platform up to date.

- Suppose you rely on third-party services or APIs, then confirm that they satisfy the stringent security standards.

Testing

Conduct rigorous testing like Alpha testing, Beta testing, Gama testing security audit, etc on your DEX platform, including front-end interfaces, backend infrastructure, smart contract, etc to ensure that all the platform’s features work seamlessly and there are no bugs.

Likewise, you can also give users access to take part in beta testing. This approach helps you gather valuable feedback, which helps rectify the pinpointed area and make refinements.

Deployment

On successful completion of testing and quality assurance, you can readily deploy your decentralized exchange on the server. One more thing is to pay attention to continuous monitoring of your DEX platform, which will help you fix any kind of issue and vulnerability. This ongoing vigilance helps you to keep your DEX platform stable, secure, and user-friendly.

Community Building

In the crypto universe, building a strong community is like a secret weapon. It is all about the engaged users who not only contribute to the growth of the platform but also help spread your exchange globally. Let me share a few tips to build your community.

Engaging Content

Keep your platform users in the loop by regularly updating them according to market trends, the latest security measures, and features.

Social Media Integration

Make it simple for your users to share their experience on social media with simple share buttons and automatic posts. It is a great way to draw more people to your platform.

Community Events

Conduct AMAs, webinars, and more events for your users. This is a fantastic way of connecting users among your user base.

Rewards System

Rewarding your users with little incentive will definitely encourage and make them actively engage in your platform.

Conclusion

To conclude, build a decentralized exchange platform is a complex task but a rewarding endeavor, forcing us to transform the financial landscape with DEX. By leveraging blockchain, smart contracts, and security measures, you can contribute to the evolution of the financial industry. As we have examined in this blog, the journey involves meticulous planning, strong development, and a deep understanding of the principles that underpin to create DEX. As the world increasingly adopts the potential of DEX, our innovative contributions will definitely reshape global finance. If you are one of the entrepreneurs to wish to step into the DeFi ecosystem by creating DEX. Then you can undeniably connect with InnBlockchain, a leading DeFi development company that helps you all the way to the successful creation of DEX.