It’s been 16 years since the first cryptocurrency, Bitcoin, came into existence. And year after year, ETH, BNB, LTC, SOL, and more are introduced to the world.

And guess what? People have started using crypto for payments, assets, and several use cases. Crypto is secure at the same time, but it carries vulnerabilities too.

To establish clear ground rules, crypto has started to be regulated for the first time by the US govt in March 2013.

When the US updates its regulations, it impacts the entire world. And now we’re in a strong need to discuss the US Crypto Regulation at this time with more updates.

Yeah! Come on, let’s decode the crypto regulation in simple terms.

What is Crypto Regulation?

Crypto regulation is the rules/laws that are implemented by the governments to lay boundaries on crypto assets on it’s usage. It specifies how digital assets like BTC, ETH, and other tokens are to be traded, stored, issued, and taxed.

The rules mainly focus on

- KYC/AML procedures – For verified users to access the platform

- Security laws – Rules for trading and storing assets

- Taxing – For entities paying taxes on their crypto gains

These regulations vary according to the country and regions, such as US crypto regulation and Canadian crypto regulations. These laws get updated regularly according to the market shifts and trends.

Okay, first, why should crypto be regulated? Let’s know the reason.

Why Crypto needs Regulation?

Crypto’s value is increasing with huge hypes in the market. And the world witnessed BTC price reaching over $125K, which takes years for ETH to reach half of the BTC average price.

So, the number of crypto users increases. Resulting in a large number of crypto holders and investors in the market.

At this time, when users store their assets in the crypto exchange platforms, their funds could be exploited. And many exchanges are prone to hacks despite being built using solid blockchain technology.

The main reasons for crypto tax compliance are

- Protecting users’ assets from scams, manipulations, or platform collapses.

- Countering illegal activities from terrorism financing and ransomware payments.

- Ensuring financial stability by imposing standards on crypto firms, as the market is volatile in nature.

- Providing legal clarity for businesses to operate their platforms with a structured framework.

- Promoting taxation allows the government to impose taxes on overall platform profits which also adds to revenue.

US is the only country with the largest number of crypto traders. Crypto regulation in the US is getting structured every season and making progress.

Shall we get to the point where it all began?

US Crypto Regulation: The Groundwork

As we’ve seen earlier that US laid the foundation for regulating cryptocurrencies in 2013. Let’s see what that regulation is and how it went.

- FinCEN

Today, we won’t even opt to trade on crypto exchanges without KYC/AML formalities. To the surprise, that procedure was brought by this regulation.

FinCEN is the law that laid a solid foundation for making the KYC/AML verification mandatory in all centralized crypto exchanges.

What does FinCEN changed?

Made all the crypto(virtual currency) exchanges register as Money Services Businesses(MSB) and follow the KYC/AML rules.- SEC & CFTC

Securities and Exchange Commission(SEC) has implemented a rule to declare digital assets as securities determined by the Howey Test (discussed in upcoming section).

Commodities Futures Trading Commission(CFTC) regulates the derivatives markets.

And we know that the US has separate jurisdictions for the state and the country. For example: New York has developed their own licensing law named BitLicense. Following the particular state’s crypto regulatory framework is also necessary for businesses.

So, why wasn’t this sufficient to prevent vulnerabilities?

After witnessing incidents like FTX and Luna collapses, the need for a comprehensive federal crypto currency legislation has grown stronger.

Let’s get to the core and mandate cryptocurrency regulation in the US, and why it’s irresistible.

SEC Crypto Regulation: Why does it Matter?

The Securities and Exchange Commission(SEC) declares a digital asset to be secured once it passes a Howey test. Isn’t it?

What’s a Howey Test?

Howey test is a procedure that an asset should undergo a 4-stage process. It involves investment and the expected profit, like elements, to determine whether the asset complies with the laws or not.

4 Stages of the Howey Test

State: 1 Investment of Money

An investor provides money to an entity to include digital assets.

Stage: 2 In a Common Enterprise

The success of investors is correlated with that of the promoter, other investors, and the overall business as a whole.

Stage: 3 With an expectation of Profits

Investors look forward to monetary benefits like dividends or appreciation.

Stage: 4 To be Derived from the Efforts of Others

Expected profits primarily result from the efforts of a promoter or third party, not the investor.

When a transaction is passed through these four paths, then it’s considered an “investment contract”.

SEC crypto regulation is vital because it

- Protects investors

- Maintains market fairness and openness

- Promotes capital formation

In order to rebuild public trust in the wake of widespread fraud and the 1929 stock market disaster, SEC crypto regulations are essential for a strong economy.

Now that you’ve got the history of US crypto regulation. We can focus on the current regulations.

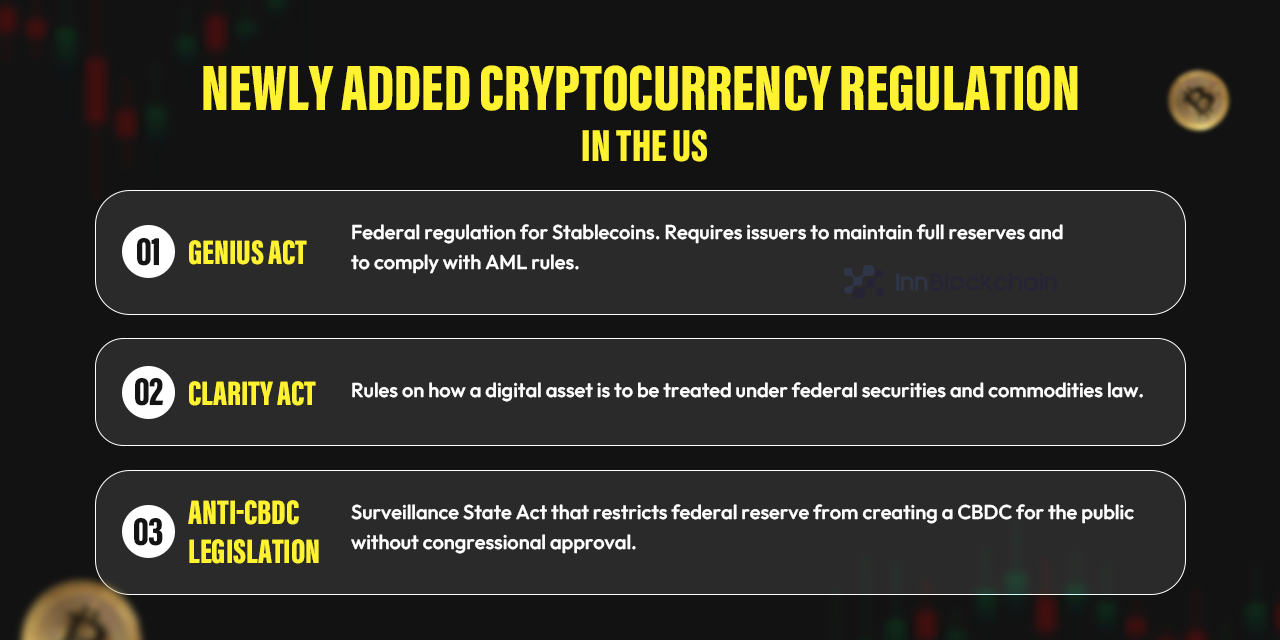

Newly Added Cryptocurrency Regulation in the US

2025 has been the greatest turning point in the history of US crypto regulation. All because of the GENIUS Act.

What’s a GENIUS Act?

The GENIUS Act laid a clear federal regulation for Stablecoins. It requires issuers to maintain full reserves and to be comply with AML rules. The act is passed in the House and the Senate.

This ensures only the approved issuers can create Stablecoins pegged to USD.

Well, not this act alone is a hero. There are a few more cryptocurrency laws in US made with a clear point of view.

The CLARITY Act is what I’m talking about right now.

- CLARITY Act lays rules on how a digital asset is to be treated under federal securities and commodities law.

- Anti-CBDC Legislation is a surveillance state act that restricts federal reserve from creating a CBDC for the public without congressional approval.

Note: Both acts have been passed by the House and are pending in the Senate.

Are you clear about the US crypto regulation framework? Now take a look at the best crypto exchanges in the USA.

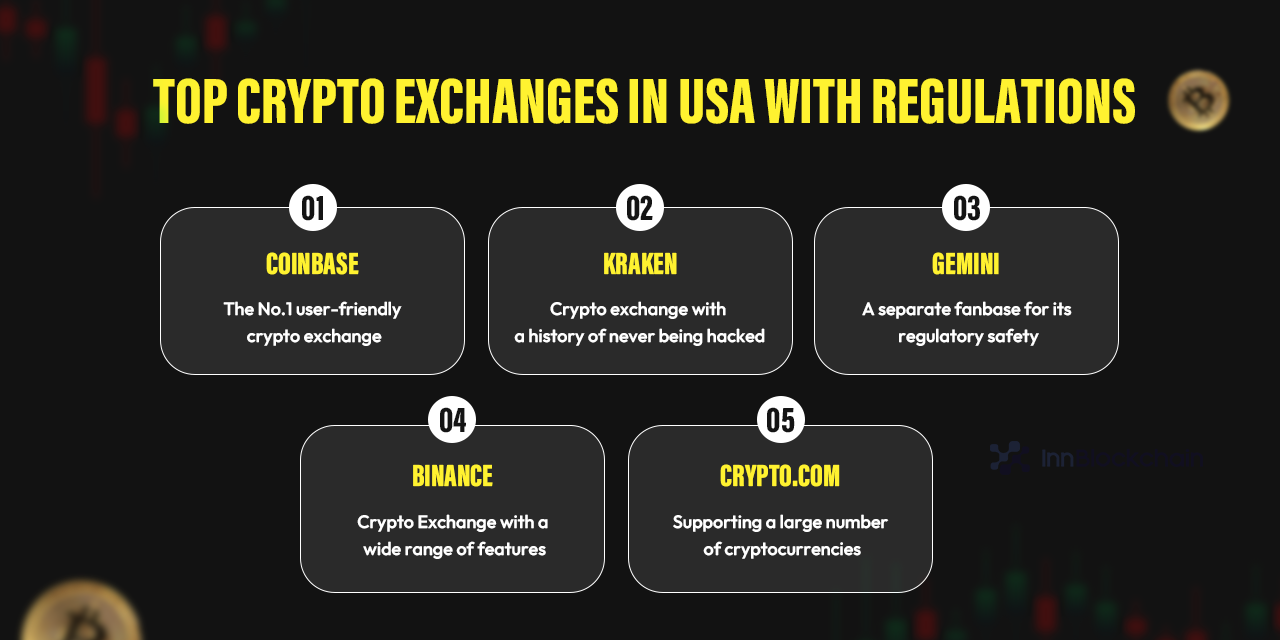

Top Crypto Exchanges in USA with Regulations

The US is not standing as the crypto hub with hundreds of successful exchanges running. We can see the top crypto exchanges in USA.

#1 Coinbase

Coinbase is the No.1 user-friendly crypto exchange with basic to advanced features. Features a dedicated app and wallet with an advanced version.

- Regulations: Registered as a Money Services Business (MSB) with FinCEN.

- Licensing: Licensed as a virtual currency business under New York BitLicense.

- Security: Cold storage and risk mitigation features

#2 Kraken

Kraken is a crypto exchange with a history of never being hacked. It holds compatibility with many devices and provides more features for advanced traders and institutional investors.

- Regulations: Registered as an MSB with FinCEN.

- Licensing: licensed as a money transmitter in many states.

- Security: Cold storage, Authorized withdrawal with GSL.

#3 Gemini

Gemini is the top crypto exchanges in US with a separate fanbase for its regulatory safety. Despite supporting currencies when compared to the other exchanges, it’s strong in terms of security and compliance.

- Regulations: Registered as MSB with FinCEN. Regulated by NYDFS under strict rules (trust charter).

- Licensing: Money transmitter licenses in multiple states.

- Security: FDIC-insured USD deposits

#4 Binance

Binance is the common name that reached every corner of the world with its wide range of features. It operates separately for US users under the cryptocurrency laws in US.

- Regulations: Registered with FinCENsubject to state licenses where offered.

- Licensing: Subject to state licenses where offered.

- Security: Advanced with cold storage support

#5 Crypto.com

Crypto.com is the top crypto exchanges in USA, supporting a large number of cryptocurrencies with a dedicated mobile app. Provides NFT access and more perks and benefits for the users.

- Regulations: Registered as MSB with FinCEN and licensed as a money transmitter in U.S. states.

- Licensing: Subject to state licenses where offered.

- Security: Cold storage and Multi-Factor Authentication

If you wish to know more about it, we can cover it as a separate article. We’ve seen the initial and the current regulatory structure of US crypto regulation.

It’s time to look forward to how the future is gonna be.

Future of US Crypto Compliance: What’s Next

As we’ve seen, the remarkable changes like the CLARITY Act are still pending approval. We can expect federal and state collaborations to bring clear crypto compliance in US.

- The asset clarification of where to put the digital assets, whether as commodities or securities.

- US’s take on retail CBDCs has been resistant till now. Which might change in the future.

- The IRS which is typically like crypto regulation in Australia and the Treasury are working to lay more strict rules for digital asset brokers and taxation.

Crypto exchanges can be vulnerable, if there isn’t a proper regulatory structure. Above all users are the ones who bear the losses in this case. In 2026, we can expect more risk-based compliance requirements that purely focus on protecting user/investor funds.

You can be a crypto investor, trader, or a startup willing to invest your lifetime savings in the crypto business. Knowing how the regulations work is more important.

Now I wish to throw the final advice to the future startup leaders.

What Businesses should take note of the US Crypto Regulation?

If any entrepreneurs wish to start their business in 2026, then setting standards is more important than decorating your platform with advanced features.

- Choose your business type whether you’re gonna start a CEX or DEX platform. US crypto regulations treat exchanges and wallets differently.

- Choose a legal structure and register your business in that state, and obtain an EIN (Employer Identification Number) from the IRS.

- Submit the form to FinCEN as Money Services Business (MSB) and implement the KYC and AML verification procedures.

- Some states require their specified licenses. Obtain a state Money Transmitter License(MTL). Eg, BitLicense by New York. (Follow the SEC crypto guidelines. In case you issue tokens and CFTC for offering derivatives)

- Integrate security features and payment gateways, and test your crypto exchange platform in the Testnet Blockchain.

Then what?

You’re ready to launch your crypto exchange in the market. After launching, perform marketing campaigns, follow the US crypto regulation guidelines, and update them regularly.

If you’re planning to start your own crypto exchange? And stuck with when and where to begin? Reach out to us. We, InnBlockchain, are the best cryptocurrency exchange development company delivering innovative and regulatory-friendly crypto exchange software.

Your journey to a successful business starts with the right blockchain development partner. Schedule your free meeting with our team and get an idea of how to start and run your crypto exchange platform.

Start your crypto business with regulatory confidence!

Articles Worth Exploring

🚀 How to start Crypto Exchange Business

💡 Crypto Startup Ideas: Comprehensive Guide for Millionaires

💸 Cost to Develop Crypto Exchange Platform

FAQs

What is the crypto regulation bill?

Crypto regulation bill is the government passed act/law on how crypto can be used, traded, and considered.

Does the SEC or CFTC regulate crypto?

Both regulate crypto. SEC is for token issuers, and CFTC is for derivatives exchanges.

What are the main cryptocurrency laws in the US?

FinCEN, SEC, and CFTC are the main cryptocurrency laws in the US.

What is the IRS compliance report?

IRS compliance report ensures that the businesses have met the federal tax filing conditions and payment obligations.

How do businesses manage crypto tax compliance?

Businesses must maintain a detailed record of their registrations and certifications. Also must update and obtain the licenses if any are required.