We’re quite familiar with the saying that “Not all the horses are born to win”. But I totally deny it. It doesn’t work in the crypto world. The one who is aware of the market trends and has a little knowledge of blockchain can become a pro trader.

In 2025, 107 million users are trading cryptocurrencies.

And still many don’t know how and where to store their assets. Coming to the point, you can be a well-versed trader, but how well you manage your assets matters.

And I’m here to direct you to understand the crypto wallet vs exchange with its pros and cons. Come on, let’s get to know what a crypto wallet is and its types.

What is a Crypto Wallet and its types?

Crypto wallet is a tool that stores a user’s private and public keys to manage their assets. This allows you to interact with the blockchain using these keys. Here’s a myth I wish to break at this point.

Many understood that a crypto wallet stores cryptocurrencies. But the private key and the public key are the main characters in managing assets.

And what does Blockchain do here? It serves as a ledger to record and maintain the balances of cryptos with their addresses.

Let me put the concept of a crypto wallet clear to you.

Understanding Crypto Wallet in Simple Terms

Just imagine our traditional bank account. We have our account number, which can be seen by all. Our friends, family, and any member can deposit funds into your account. But nobody can take the funds from your account without your signature.

The same way a wallet works.

- The account number is the public key visible to all.

- The signature is the private key where funds are accessed.

💡What you need to know

Roughly 40-70 million users are holding their cryptos in the wallets.

Yeah, a decade ago, the exposure to store funds in the wallet was so less. Now, the users of wallets are increasing. But you need to know that there are different types of wallets existing in the market.

What are they? Let’s take a look at them.

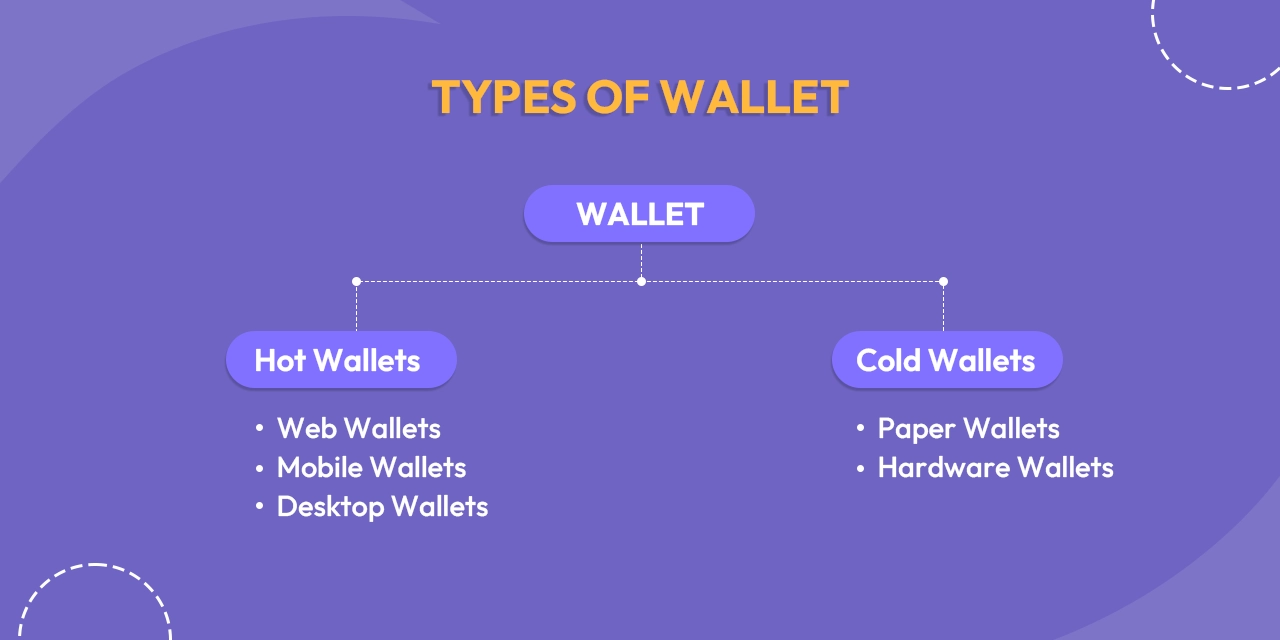

Majorly, we can classify crypto wallets into two categories.

- Hot Wallets [Online Access]

- Cold Wallets [Offline Access]

Hot Wallets

Hot wallets work with an internet connection, making the transaction easy and convenient.

Examples

- Web Wallets – accessed through a web browser

- Mobile Wallets – accessed through a mobile app

- Desktop Wallets – accessed by installing software on a computer

Cold Wallets

Cold wallets store private keys offline and give the highest security, but a bit hard for instant access.

Examples

- Paper Wallets – taking a printout of the public and private key

- Hardware Wallets – through a physical device like a USB Drive

Store your assets based on the type of trading frequency and methods. If you’re a frequent trader, then opt for a hot wallet. If you’re a sort of arbitrage trader, then opt for cold wallets.

Well, we’re missing out on the popular wallets that are recently being treated as the OG of crypto wallets. Apart from the types we’ve discussed above, there are two other types.

- Custodial Wallets

- Non-Custodial Wallets

A custodial wallet is a third-party store that manages the key on behalf of the user. It’s like storing assets in a crypto exchange. We’ll discuss in detail in the next sections.

Non-custodial wallets allow you to manage the entire transaction by yourself. (You’re responsible for your private keys)

Before getting into crypto wallet vs exchange, it’s time to know what a crypto exchange is and its types.

What is Crypto Exchange and its types?

Crypto Exchange is a software that allows users to buy/sell cryptocurrencies like BTC, ETH, with cryptos and fiat currencies. Users can trade with multiple features, with leverage, loans, prediction, and also raise funds from it.

If we speak about the cryptocurrency exchange features, they’re vast. Apart from spot, margin, and futures, many features are being developed today. Now we can see how crypto exchange platforms are classified.

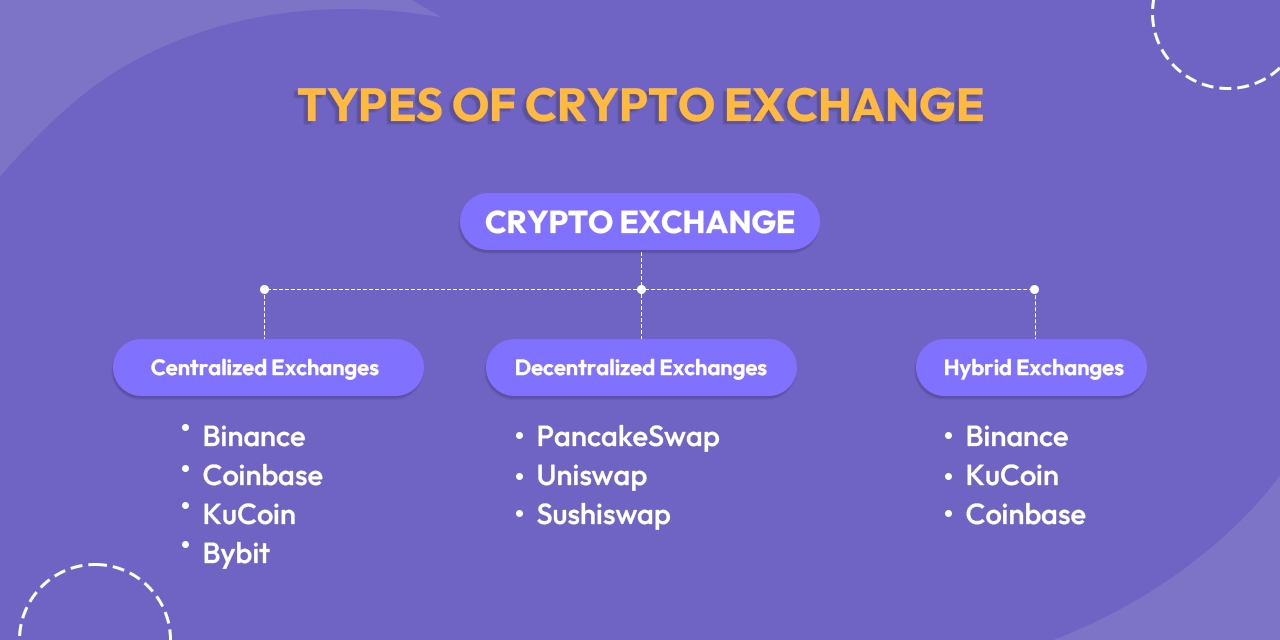

Types of Crypto Exchanges

The 3 main types of exchange are

- Centralized Exchanges

- Decentralized Exchanges

- Hybrid Exchanges

Centralized Exchanges are platform that allows users to trade cryptocurrencies with the central authority, probably under admin control.

Example: Binance, Coinbase, KuCoin, Bybit

Decentralized Exchanges enable users to buy and sell cryptocurrencies without any intermediaries or identity verification.

Example: PancakeSwap, Uniswap, Sushiswap

Hybrid Exchanges combine the features of centralized and decentralized exchanges and allow users to enjoy both the benefits.

Example: Binance, KuCoin, Coinbase

So, how are cryptos seen today?

Cryptos are now considered as an asset like gold 💰 to invest in now and get the maximum returns after a certain period.

Planning to invest your crypto for high returns? Here’s 👇 the estimate of your annual income on starting a crypto exchange business.

Alright, we can get to the crypto wallet vs exchange now.

How is a Cryptocurrency Exchange different from a crypto Wallet?

Crypto exchanges are the prime source of a platform for trading cryptocurrencies and fiat under various trading features. Crypto wallets are the storage medium, typically like our traditional bank account.

Here’s the crypto wallet vs exchange.

| Feature | Crypto Wallet | Crypto Exchange |

| Prime Purpose | Secure storage and control over crypto assets | Trading cryptos with cryptos and fiat |

| Control of Private Keys | Users have 100% control of private keys | 100% exchange control |

| Security | High security in terms of cold storage | Lower security in case of an unexpected hack |

| User Experience | A bit complex for beginners to access their funds | Simple and easy to access the funds |

| Transaction Charges | Withdrawal charges based on the blockchain network user chooses | No withdrawal charges when it occurs in native blockchain networks |

| Best For | Intermediates and Pro traders | Active traders, like day traders, for frequent trading |

| Accessibility | Globally accessible with slight variations | Restricted to some countries based on their compliance |

Hope I’ve put the main points clearly. It’s time to go further deep with their key advantages and disadvantages.

Pros and Cons of using Crypto Wallet

The active crypto wallet users have seen a surge in 2025. The awareness of holding assets in wallets is getting reached.

Hot wallets are the most preferred wallets among users, accounting for approximately 78% of all crypto wallets.

Cold wallet ownership has increased by 34% in 2025.

And now we’re getting into the detailed analysis on crypto wallet vs exchange.

Pros of Using Crypto Wallets

- Security: Storing assets in the wallets is secure when it comes to long-term holding. Both hot and cold wallets give security. But when you opt for cold storage, you’re in the safe zone.

- Accessibility: We do know that hot wallets are easily accessible to withdraw or deposit assets.

- Cross-border Payments: Transferring funds through a wallet is more convenient in case of other countries.

- Controlability: You have complete control over your assets. That is, you can withdraw, deposit, or even freeze your funds whenever you want.

- Risk: If you store your assets in the wallet, you won’t hold your funds. Every asset is stored in the admin’s wallet. Storing in wallets makes your savings free from hacks.

Cons of using Crypto Wallets

- Loss of Funds: If you lose your private keys, it’s hard to retrieve them. When you open an account on your wallet’s private key and the seed phrase are generated.

A seed phrase is a group of phrases that are to be noted and used to retrieve your assets in case you lose your private key. If you haven’t taken note of your seed phrase, then you would lose your assets. In short, it’s a backup for your savings.

- Complexity in Usage: Starting with wallets could be intimidating for beginners. And users fail to manage their assets properly.

- No Dispute Resolution: Once you send your funds to the wrong address, then there’s no possibility of recovering your funds. The funds lost remain lost.

The summary is that storing assets in the wallets is completely safe. But it’s not suited for beginners to start over. For intermediates and pros, wallets are the best and mandatory option to secure their assets.

Also, if you want me to give a step-by-step guide on using a crypto wallet, then let me know in the comments.

Here are the exclusive cold storage options for pro traders to keep their cryptos safe. Take a look at them. And beginners, just save this option to store your assets in the future.

Best Cold Wallet for Beginners

Before talking about exchanges, I’m gonna put the beginner-friendly options for newbies. Some users are opting for cold storage from the initial level of trading.

Best cold wallet for beginners are

- Tangem Wallet

- Ledger Nano S Plus

- Trazor Model One

Tangem Wallet – Easy setup and no requirement for backup seed phrase

Ledger Nano S Plus – Supports multiple assets with clear transaction verification

Trezor Model One – Easy entry with PIN and passphrase entry

Choose the one that seems convincing and convenient to your type of trading. Importantly, first study the quick guide and then start using the wallet.

So, shall we finish the crypto wallet vs exchange part?

Pros and Cons of Crypto Exchange

There are different types of crypto traders (day traders, swing traders, etc.). Whatever may be, a crypto trader seeks for convenient medium of exchanging assets. In that way, using a crypto exchange platform is an effortless way to access the funds.

Pros of Storing Assets in Crypto Exchange

- User-Friendliness: Traders withdraw, deposit, and convert assets frequently. Exchanges give you a clear dashboard to manage and perform transactions.

- Faster Transactions: Within seconds and minutes, you can transfer your assets with multiple features.

- Easy Account Recovery: You don’t need to note down any seed phrases as in the wallets. If you forget your password, you can still log in with your email and ID verification.

- Fiat Integration: Many crypto exchanges already support multiple fiat currencies. So, no matter where you trade, you can always access your native currencies to buy or sell cryptos.

- Transaction Fees: If the assets are transferred over the platform’s native blockchain, then no fees are charged. Even when you transfer the assets to your existing external wallets, like MetaMask.

Cons of Storing Assets in Crypto Exchange

- Security Concern: Storing in a crypto exchange means that all the users’ funds are stored in the admin’s wallet. So, it’s prone to hacking. But there’s a case. If the platform stores funds in cold storage, then despite hacking, all users’ funds will be safe.

- Privacy: Users need to pass through the KYC process by submitting their government-issued documents to access the platform. Crypto wallets don’t ask you such kinda information.

Related: How do cryptocurrency exchanges work?

I’m glad that you’ve got a complete comparison of crypto wallet vs exchange now. And now is the time to wrap this up.

Crypto Wallet vs Exchange: So what’s best?

As a trader, you need to be clear about your asset usage. How often you trade and how much quantity of assets you trade. Above all, I wish to throw a gentle suggestion here. It’s good to store your assets in a crypto exchange and also in a crypto wallet.

Split the assets and hold them accordingly in each based on your trading and holding priorities. Despite having the pros and cons, both are integral when you’re investing in crypto.

One Last Thing

A special note to crypto traders wishing to invest their crypto on the right path. Many pro traders and Bitcoin holders are struggling with where to invest their crypto. And I’m not gonna suggest something strange to you.

Investing in building a crypto exchange from scratch is recognized as a promising business idea. Book a free consultation with our Cryptocurrency Exchange Development Company and get insights on starting a crypto business.

Well, hope your next trade hits the jackpot!

Wanna start your crypto exchange business? 👉

FAQs

Is it better to keep crypto in wallet or exchange?

If you’re a frequent trader, then keep your assets in exchange. If you’re a long-term holder, then store your assets in a wallet.

Does it cost to send crypto from exchange to wallet?

Yes and no. It depends on the blockchain network you choose. If you send crypto from the exchange’s native blockchain, it occurs zero fees.

Are crypto wallets safer than exchanges?

Yes, when it comes to cold wallets. Hot wallets are prone to hacking.

How to build your own crypto exchange?

You need to have a clear idea, then team up with a reputable partner and acquire the required licenses.